Calculate my hourly paycheck

To calculate annual salary to hourly wage we use this formula. If you get paid bi-weekly once every two weeks your gross paycheck will be 1 731.

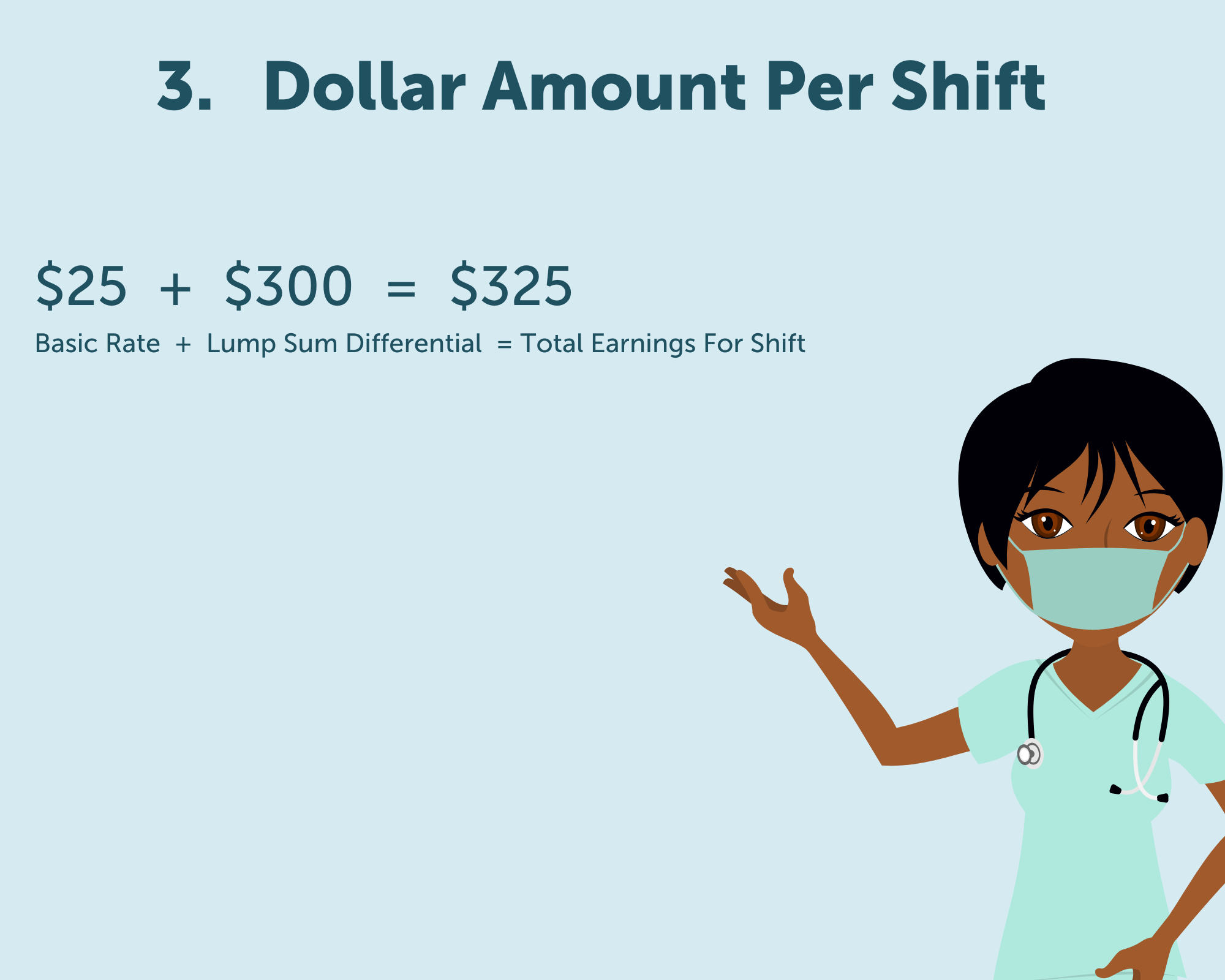

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll

Multiply the time and a half rate by the number of overtime hours the employee worked to find the overtime wages due.

. This calculator can convert a stated wage into the following common periodic terms. Find the time and a half rate by multiplying the standard hourly rate by 15. Free salary hourly and more paycheck calculators.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. To calculate annual salary to hourly wage we use this. For hourly employees you can calculate time and a half by using the following steps.

The gross pay for an hourly employee is calculated by multiplying the number of hours worked in a pay period times the hourly rate and including hours for overtime at the overtime rate. She is entitled to overtime for 3 hours at 15 times her hourly rate. If you make 45 000 a year how much is your salary per hour.

Free for personal use. If you dont want the download the free rate calculator above the math goes like this. 2022 Salary Paycheck Calculator Usage Instructions.

Convert my hourly wage to an equivalent annual salary. A yearly salary of 60000 is 3077 per hourThis number is based on 375 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid. You want to determine how much the raise is what their new annual wage will be what their new biweekly paycheck is and how much more they will receive per paycheck.

Learn about the benefits of this safe and fast way of getting your pay directly on your bank account. How To Calculate Paycheck Withholding and Deductions. Calculate the standard hourly rate of the employee.

Enroll in Direct Deposit. If you want to better understand hourly net pay calculate take-home wages or run hypothetical scenarios input your numbers into our free hourly paycheck calculator. Then determine how much you were paid during that pay cycle.

For example Carlos worked 44 hours during a week at 1250 an hour. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator. This number is the gross pay per pay period.

How to calculate your paycheck. If you receive a monthly paycheck multiply the amount you got paid via your last paycheck by 12. So lets say you need to make 5000month to live expect your business expenses to be about.

For premium rate Time and One-Half multiply your hourly rate by 15. To calculate your annual income before taxes obtain a copy of your most recent paycheck. If her hourly rate is 12 she receives overtime at the rate of 18 for 3 hours totaling 54 of overtime.

This overtime of 54 is added to her regular hourly pay of 480 40 hours x 12 for a total of 534. Calculate withholding using supplemental tax rates on special wage payments such as bonuses. Also you may want to see if you have one of the 50 best jobs in America.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. If you already know your gross pay you can enter it directly into the Gross pay entry field. Are you looking for more information about a wage offered by a prospective employer.

Fill in the employees details This includes just two items. We calculate file and pay all taxes for you automatically. Divide your pay amount by the number of pay cycles.

How To Calculate Pay and. Use this calculator to determine your equivalent annual salary when given what you get paid per hour - it may surprise you what you make on a yearly basis. Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweekIssuing comp time in place of overtime pay is not allowed for non-exempt employees.

Find the banks that offer free checking. Learn what to do if your paycheck is lost stolen or damaged. Sandy works 43 hours in one week.

Hourly Rate Bi-Weekly Gross HoursYear Calculating Premium Rates. For instance for Hourly Rate 2600 the Premium Rate at Time and One. Its even simpler if you are paid a fixed salary.

Hourly employees must be paid premium wages for each hour worked on a holiday plus an additional amount as holiday pay equal to 12 of the regular rate of pay. Salaried employees comes in the form of adding onto an employees regular pay. Again you can determine how much the employees paycheck increases by dividing their annual salary by 52 weekly 26 biweekly 24 semi-monthly or 12 monthly.

Try Out Our Free Hourly Paycheck Calculator. Figuring out how much to save under the 10 savings rule is about as simple as an equation gets. Your gross pay will be automatically computed as you key in your entries.

Employers must provide an employee with 24 hours written notice before a wage change. Total Monthly Living Expenses L Total Monthly Business Expenses B Total Billable Hours Per Month H Total Taxes T Your Minimum Hourly Rate LH 1 T BH Example. Enter your annual salary to calculate your bi-weekly gross.

The base hourly rate will display on the. Hourly weekly biweekly semi. The Ohio State University uses a paperless system for all paychecks and pay stub information.

Holiday pay can apply to both hourly and salaried employees the difference for holiday between hourly vs. A yearly salary of 45 000 is 2163 per hourThis number is based on 40 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid. Check out the Frequently Asked Questions about pay.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. You may also want to convert an annual salary to an hourly wage.

If you are paid hourly your gross pay might vary from paycheck to paycheck. Their name and the state where they live. All faculty staff and student employees can receive their pay stub information online.

The hourly rate displayed on the payslip will not reflect the rate that was used to calculate the payment. In that case your regular paychecks will all be the same which means you only have to calculate the amount once. Employers are required provided certain conditions are.

If you make 60000 a year how much is your salary per hour. Heres a step-by-step guide to walk you through the tool. My Paycheck Pay Calendars My Finances Ordered Deductions.

If you get paid bi-weekly once every two weeks your gross paycheck will be 2308. If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours.

Base Salary And Your Benefits Package Indeed Com

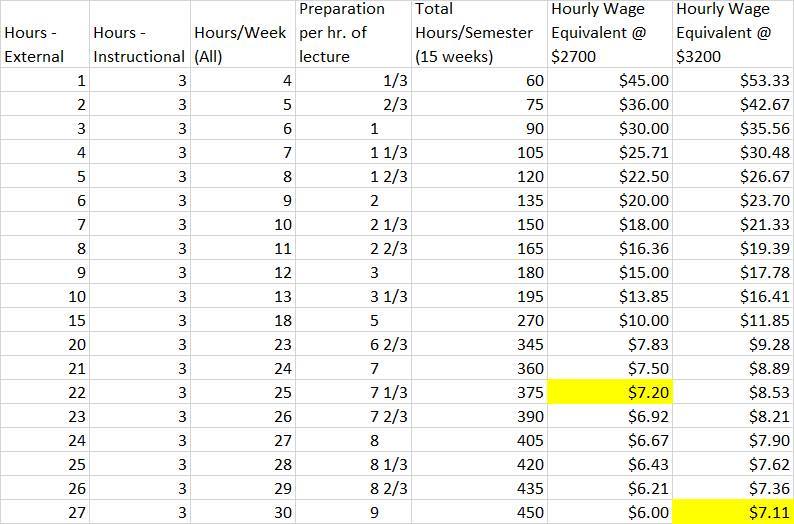

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

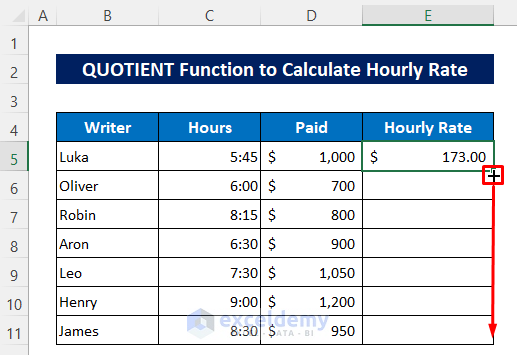

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate Wages 14 Steps With Pictures Wikihow

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

Hourly To Salary What Is My Annual Income

How To Calculate Wages 14 Steps With Pictures Wikihow

3 Ways To Calculate Your Hourly Rate Wikihow

Paycheck Calculator Take Home Pay Calculator

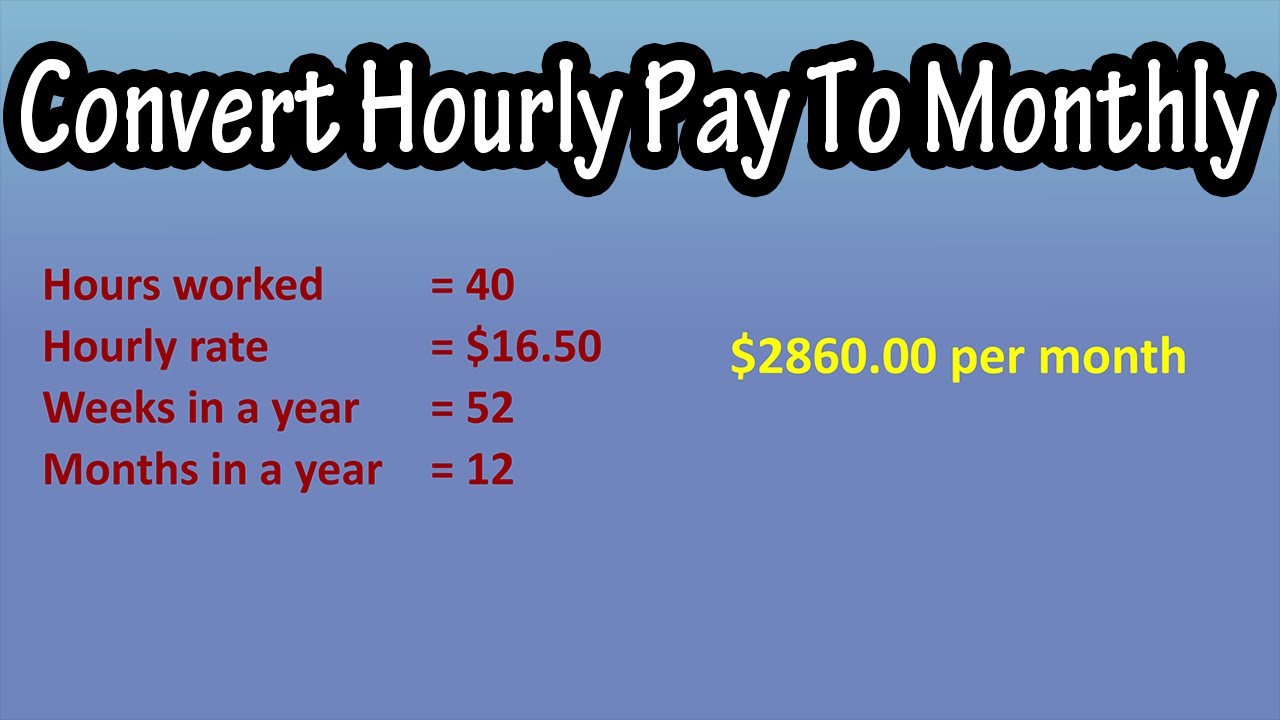

How To Calculate Convert Monthly Salary Earnings Pay From Hourly Pay Rate Formula Monthly Pay Youtube

Hourly To Salary Calculator

Pay Raise Calculator