Depreciation formula for rental property

When it comes to depreciation of rental properties the straight-line method is. By conducting a cost segregation.

How To Calculate Depreciation On Rental Property

The Straight-line Depreciation Method Is The Most Common Way To Depreciate Rental Property.

. The result is 126000. Ad Get Access to the Largest Online Library of Legal Forms for Any State. This leaves the capital gains on the property sale at 155000 or 265000 110000.

However appliances in a rental. Depreciation is simply a way to spread expenses over time for tax and other financial benefits. How accelerated depreciation on rental property works.

If capital gain tax is 15 and recaptured depreciation is at 25 we can deduce the. Using the above example we can determine the basis of the rental by calculating 90 of 110000. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

There are two types of MACRS. Under the most commonly used United States tax rules residential rental property is depreciated over 275 years and nonresidential real property is depreciated over 39 years. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken.

So the basis of the property the amount that can be depreciated would be. It allows them to deduct the cost of their property along with. The depreciation method used for rental property is MACRS.

Rental property depreciation methods include straight-line accelerated and bonus depreciation. Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills. The standard useful lifespan for rental properties is 275 years.

Residential rental real estate is depreciated over 275 years. The straight-line depreciation method is used to depreciate the rental property by the same amount every year. To find out the basis of the rental just calculate 90 of 140000.

Straight-line depreciation is used to depreciate rental property by the same amount each year. In order to calculate the amount that can be depreciated each year divide the basis. Mlb the show 22 speed ratings.

Depreciation of rental property. 100000 cost basis x 1970 1970. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

The residential investment property generally. GDS is the most common method that spreads the depreciation of rental property.

14249 Schedule E Disposition Of Rental Property

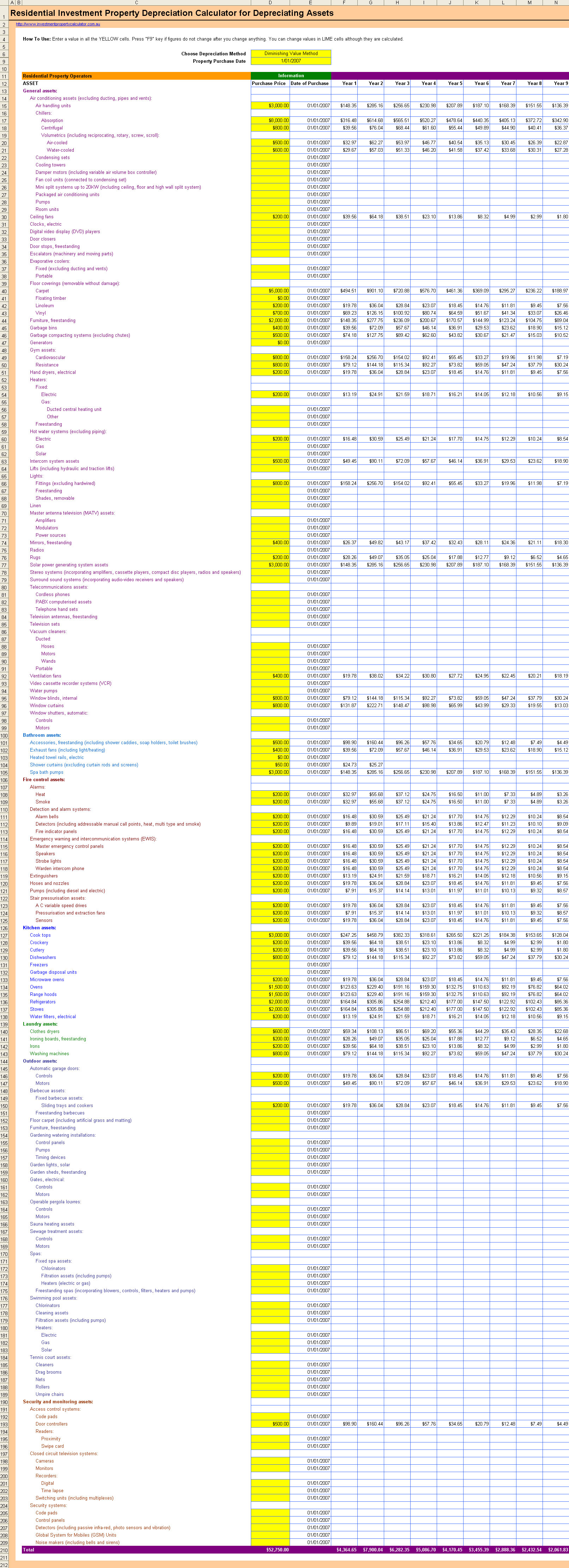

Free Investment Property Depreciation Calculator

Residential Rental Property Depreciation Calculation Depreciation Guru

Form 4562 Rental Property Depreciation And Amortization

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Duo Tax Depreciation Schedule What You Need To Know Duo Tax Quantity Surveyors

Group Sale Calculations

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation And Off The Plan Properties Bmt Insider

Residential Rental Property Depreciation Calculation Depreciation Guru

Tax Calculator For Rental Property Online 54 Off Rikk Hi Is

Residential Rental Property Depreciation Calculation Depreciation Guru

Tax Depreciation Report Sample Duo Tax Quantity Surveyors

Depreciation Of Building Definition Examples How To Calculate

How Claiming For Depreciation Boosts Property Cash Flow

Back To Basics On Property Depreciation Rent Blog